Will There Be Monthly Ctc Payments In 2025 - Irs Ctc 2025 Monthly Payments Amanda Annadiana, In this article, you’ll find details about the 2025 payment dates, eligibility for the irs ctc monthly payments in 2025, and how to apply for these benefits. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025. Ctc Stimulus Monthly Payments 2025 Bel Fidelia, The bill would increase the maximum refundable amount per child to $1,800 in tax year 2025, $1,900 in tax year 2025, and $2,000 in tax year 2025. At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax.

Irs Ctc 2025 Monthly Payments Amanda Annadiana, In this article, you’ll find details about the 2025 payment dates, eligibility for the irs ctc monthly payments in 2025, and how to apply for these benefits. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025.

3000 New CTC Payment Increase 2025 Check Dates & Who Is Eligible?, Ctc monthly payments 2025 from the irs are expected to go into impact beginning on july 15,. Washington — the internal revenue service and the u.s.

CTC Payments 2025 Navigating the Changes in Child Tax Credit, Irs ctc monthly payments 2025. In tax year 2021 only there were advance ctc payments sent from july 2021 to.

Beginning on july 15, 2025, the child tax credit (ctc) payments will offer substantial financial support to qualifying households across the united states.

Will There Be Monthly Ctc Payments In 2025. “those aged six to seventeen will receive $250 every month. Biden aims to revive monthly child tax credit payments in 2025 budget plan.

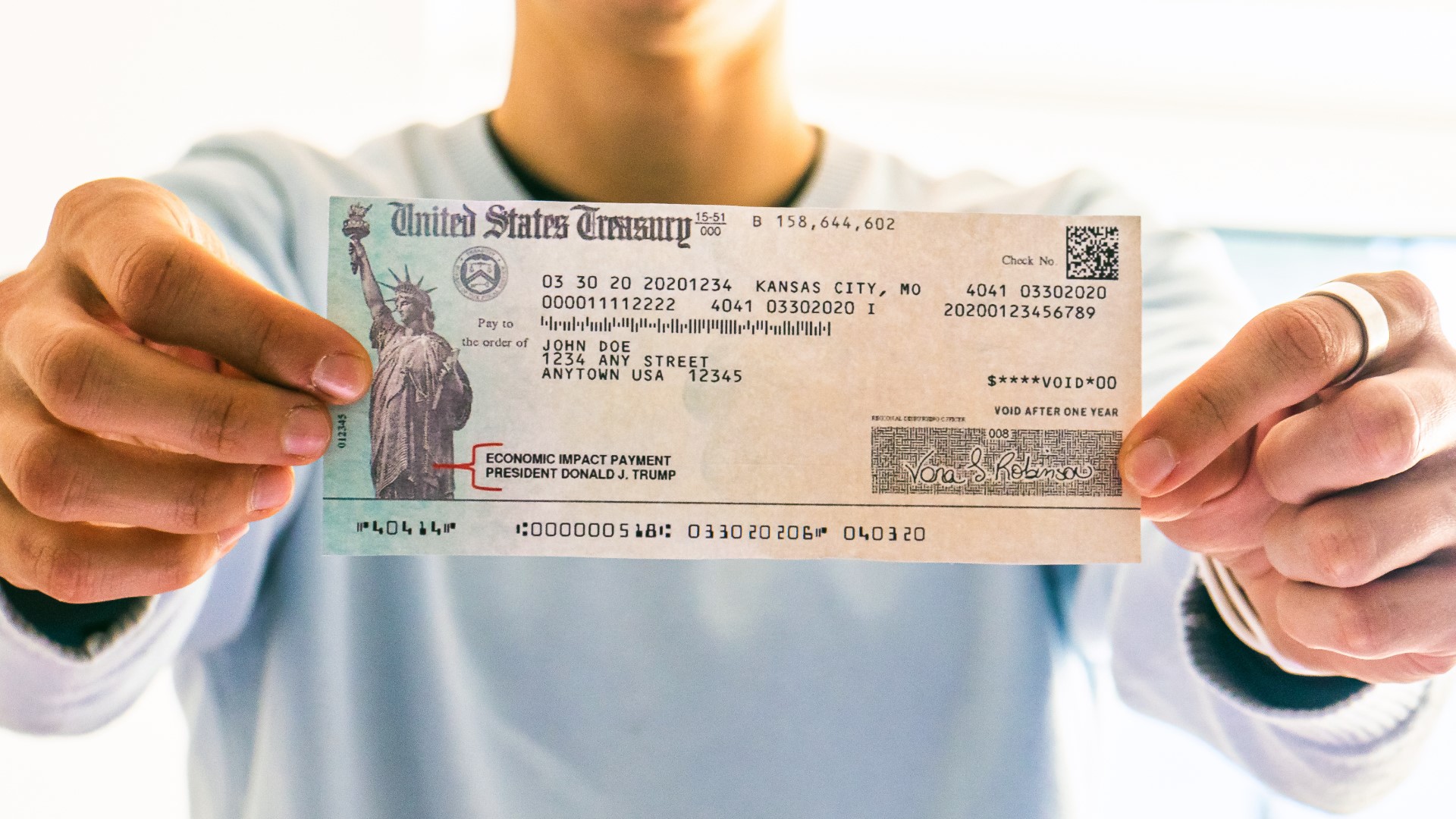

Ctc Payments 2025 Calculator Nc Jan Rozella, Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and treasury and. Irs ctc monthly payments 2025.

Biden aims to revive monthly child tax credit payments in 2025 budget plan.

Ctc Payments 2025 Calculator Ny Jeanne Doralyn, In this article, you’ll find details about the 2025 payment dates, eligibility for the irs ctc monthly payments in 2025, and how to apply for these benefits. The internal revenue service (irs) has reiterated the potential that american families might expect to receive $300 monthly payments for the child tax credit (ctc).

300 Ctc 2025 Payment Schedule Bobine Brianna, Child tax credit 2025 update. The taxpayer must file a tax year 2021.

Households covering more than 65 million children will receive the monthly ctc payments through direct deposit, paper check, or debit cards, and treasury and. “those aged six to seventeen will receive $250 every month.

Ctc Payments 2025 Schedule Manon Danielle, After that, payments will likely follow a consistent schedule, arriving on the 15th of each month. Department of the treasury announced today that the first monthly payment of the expanded and.

C Payment Dates 2025 For Ctc Ellen Harmony, The bill would increase the maximum refundable amount per child to $1,800 in tax year 2025, $1,900 in tax year 2025, and $2,000 in tax year 2025. Department of the treasury announced today that the first monthly payment of the expanded and.

When To Expect Tax Refund With Child Credit 2025 Feb 2025 Calendar, The taxpayer must file a tax year 2021. The internal revenue service (irs) will disburse these advance payments monthly from july to december of 2021.